The Best Scenario For Refinancing

$152,160.64 (copied from above) loan start date: You have a current mortgage at 5% and have been approved for a new mortgage at 3.75%.

The best scenario for refinancing is:

The best scenario for refinancing. Choose the best scenario for refinancing. Are interest rates higher or lower on a mortgages such as a 30 year loan or on a 15 year loan? Choose the best scenario for refinancing the best scenario for refinancing:

Types of loans to calculate include: Many homeowners in states like utah and arizona like. [ you ll break even on the closing costs in two years, and you don t plan to move for at least five.

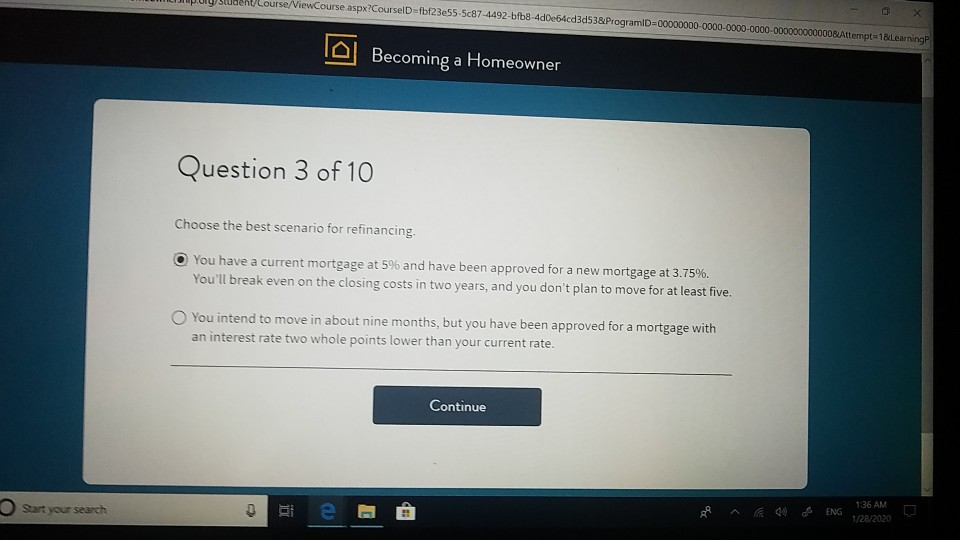

You'll break even on the closing costs in two years, and you don't plan to move for at least five. [ you’ll break even on the closing costs in two years, and you don’t plan to move for at least five. How do i know if it’s a good time to refinance?

You have a current mortgage at 5% and have been approved for a new mortgage at 3.75%. [ you’ll break even on the closing costs in two years, and you don’t plan to move for at least five. Choose the best scenario for refinancing the best scenario for refinancing:

The best scenarios where you can win in refinancing. Generally, the point of replacing the old mortgage with a new one is to save interest from then on. Then you can see how your monthly payment will be affected and how much you can expect to pay in closing costs.

The best scenario for refinancing: Yet way too many homeowners do nothing when rates drop. You have a current mortgage at 5% and have been approved for a new mortgage at 3.75%.

You have a current mortgage at 5% and have been approved for a new mortgage at 3.75%. If you bought a home during a time with a higher interest rate than what we’re currently seeing, then this could be a good time for you to refinance. Best case scenario, lenders can close a mortgage refinance within two to three weeks if the loan application and approval goes smoothly, says greg mcbride, chief financial analyst at bankrate.

You want to lower your interest rate. Overall interest rates went down. Refinancing from 4.5 percent to 3.5 percent on a $200,000 loan.

If one of the scenarios outlined above applies to you and you’re considering home refinancing, there are a few steps to take before you begin the process. Choose the best scenario for refinancing. An ideal scenario for conventional refinancing is a fico score above 700 and an ltv below 60 percent.

You’ll break even on the closing costs in two years, and you don’t plan to move for at least five. Student loan refinancing on the other hand can be done with multiple loans (federal or private student loans), and it can also be done with one loan. Applying for a mortgage refinance in utah is a popular way to reset the clock of your home loan with a smaller interest rate or a shorter term.

As you can see, refinancing is an important part of managing the investment you call home. You have a current mortgage at 5% and have been approved for a new mortgage at 3.75%. So many that researchers are trying to figure out why.

Question 3 of 10 choose the best scenario for refinancing. You have a current mortgage at 5% and have been approved for a new mortgage at 3.75%. Borrowers can qualify for refinancing with ltvs of 80 percent or lower.

Take the example from no. You’ll break even on the closing costs in two years, and you don’t plan to move for at least five. The best scenario for refinancing:

For example, if interest rates have fallen since you first took out your mortgage,. This is because, being aware that you will break even on the closing cost in 2 years which is quite better when compared to no of years to stay (atleast five years) gives the person a competitive advantage. You’ll break even on the closing costs in two years, and you don’t plan to move for at least five.

If you are refinancing with the goal of lowering your interest rate, many industry experts believe you should not refinance unless the interest rate is at least 2% below your current mortgage rate. For this example, assume the following: If you put that $115 toward principal every month, you’ll pay off your mortgage more than five years early.

The goal with refinancing is to get a rate reduction, and it involves getting a new loan with a different (ideally lower) interest rate. Interest rate on new loan: The lower interest rate drops your monthly payment from $1,013 to $898, a savings of $115 per month.

Figure out what your new loan would look like if you refinance. Your financial situation will dictate what type of refinancing might make sense. Generally speaking, if the current rates are lower than when you secured your initial home loan, a new loan could save you a sizable chunk on your monthly payment.

Posting Komentar untuk "The Best Scenario For Refinancing"